Digital transformation is a much-discussed topic that’s only become more heated in recent years, as technological capabilities improve and customer demand heightens. When it comes to the utility sector specifically, an industry that’s long been pegged as slow to move and traditionally stuck in its old ways. Digital transformation in utilities is a complex story.

The possibilities of a more digitally engaged utility industry are immense: smart meters to empower consumers and create a more automated grid; digital platforms to engage customers in new and innovative ways; cybersecurity initiatives are woven into the fabric to protect the power grid; smart devices connected directly to the utility that enable programs to adjust the thermostat or electric car charging patterns and pay customers for that flexibility; and so much more.

Why does the utility industry find itself in this state? Let’s dig into the Trianz report to find out more, including how utility professionals can reverse the trend to become business leaders for digital transformation.

What is the Trianz report measuring?

Trianz is a leading voice in digital evolution across all areas of the business world, and as a part of this role, they recently published their ‘State of Digital Transformation Worldwide: 2020’ report. In it, they provide findings relating to what industry leaders are doing right and wrong when it comes to the future of digital transformation.

Specifically, Trianz surveyed over 9,000 leaders across 18 industries about what their companies are (and aren’t) doing to advance digitalization. Based on these responses, the report provides data-backed conclusions about what industries are leading the digital charge, which are falling behind, and what the leaders in each sector are doing to differentiate themselves.

How exactly does the utility industry rank today?

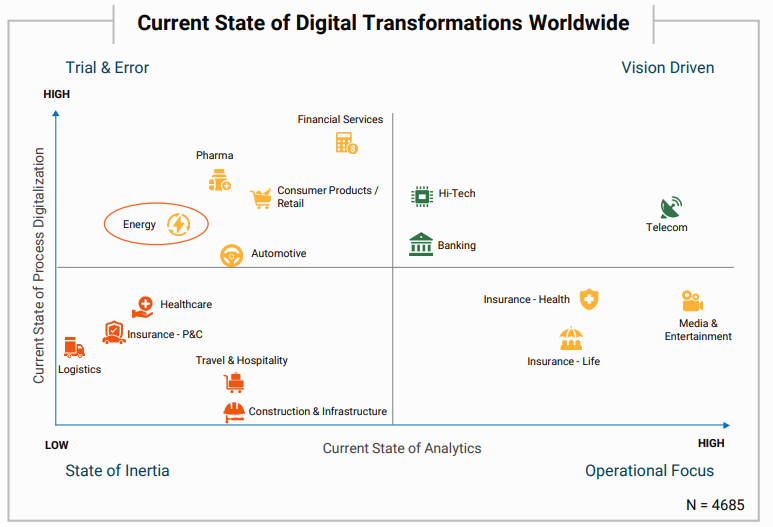

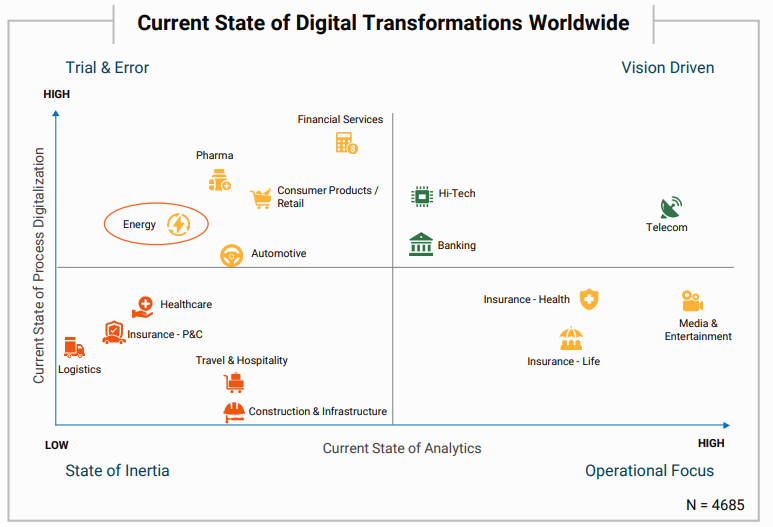

In gathering their insights for the state of each industry, this report measures two main components as a result of the executive survey results:

- How mature is the use of analytics in your business functions?

- What percentage of processes in your business functions are digitalized?

See below how the energy sector ranked:

Energy companies, in aggregate, were found to be behind the times in the current state of analytics, but slightly ahead of the curve for the current state of process digitalization.

According to the report, this places the utility sector in the “Trial & Error” bucket, meaning that, as a whole, they’re “reacting to pressures or digitization processes without adequate analysis.”

Put another way, this report finds that utilities are wanting to engage in digital transformation and are trying to do so, but the process of getting from the old ways to the new digital ways of doing things are not suitably informed by data analytics.

Utilities appear to want to digitalize, but instead of properly studying how best to do so, they’re blindly throwing darts at the board and hoping something sticks.

There’s reason to believe that utility leaders are being pressured by external forces to embrace digital technologies and to do so fast. This pressure may be coming from shareholders, customers, regulators, or even just general pressure to shed the reputation as an inertia-filled industry.

Such pressure, especially being placed on executives who fear being replaced if they don’t keep up with the times, can result in rushing into digitalization without properly studying how best to do so. This sentiment is repeated in a recent report by Cognizant, which found that:

Until recently, [energy & utility] organizations have had the luxury of moving slowly into the digital economy, given the industry’s very regional nature, the brand value that companies have acquired over the years and the fact that their operating models were tightly aligned with the way utilities traditionally conducted their business. As we move beyond the early days of the digital economy, however, the timer is going off. With the increasing availability of distributed energy resources, [they] now face competition from new market entrants equipped with the latest digital technologies, processes and organizational models that cater to the needs of the energy consumer.

The transition into the digital economy is suddenly rushed, with the catalyst being outside the organization itself, and there is evidence of a patchwork and perhaps even sloppy implementation.

What’s the future outlook?

If the state of digital transformation in utilities today is a mixed bag, what does the Trianz report say about the trends?

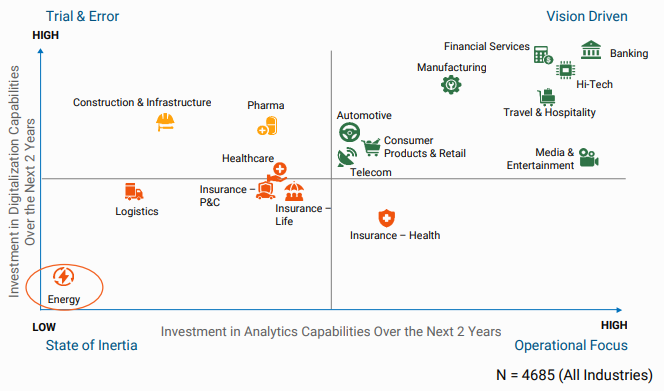

The survey also asked executives: “How do you plan to advance digitalization and analytics in all business functions over the next 2 years?”

Given that they were lagging behind, you would think utilities have every incentive to try to make up for that by spending big in the coming years. Unfortunately, the results of this question painted an even worse picture for the industry:

Energy companies are found to be the lowest on the totem pole for investment in analytics capabilities and investment in digitalization capabilities, and it’s not even close. This pegs the utility sector as being in a ‘state of inertia’ or “slow-moving, cost-centric and often heavily regulated.”

Utility industry observers will recognize these labels that have been slapped on the sector for many years, so while the results are disappointing, they can hardly be surprising.

Utilities are heavily restricted in their investments, as they typically need to be defended by regulators. This is because the costs will get passed onto customers, who are unhappy with any rate increases (even if they would benefit from the associated upgrades).

All the pressures discussed previously that are influencing newfound interest in digital transformation are typically coming from outside sources: utility vendors and solutions providers, as well as driven by the market for electric vehicles, smart thermostats (which is rapidly increasing) and other innovative technology. Utilities are, in that way, typically more reactive than proactive, and a non-proactive industry will lag behind their planned investments in digital transformations.

The first two graphs (depicted above) tell the story of a frustratingly stagnant industry that’s at risk of falling into an unhealthy and stalled state compared with other businesses.

How can utility operators prevent further stagnation?

All hope is not lost, as many shrewd, forward-looking, and dynamic people are making waves in the utility industry and seeking to fight the inertia that has kept the sector behind.

That future of successful digital transformation must be built on a solid foundation. A company cannot expect to digitize too rapidly, or it risks being non-sustainable or inefficient in how resources are allocated towards that goal.

The first piece of advice for utility operators is to really internalize the digital transformation goal. Digitalization can be spurred on by outside pressure, but that pressure must inspire an internal realignment of goals.

Ask yourself:

- Why do you seek digital technologies?

- What are the digital goals internally and for your customers?

- What metrics will you use to track that digital transformation journey?

Looking introspectively at these topics will help ensure that digital transformation becomes a part of the business DNA and not just a one-off project or a to-do list.

The next important task for utilities to realize is that digital transformation technologies build upon each other. Too often the utility industry has suffered from siloes where one department doesn’t know what the other is doing.

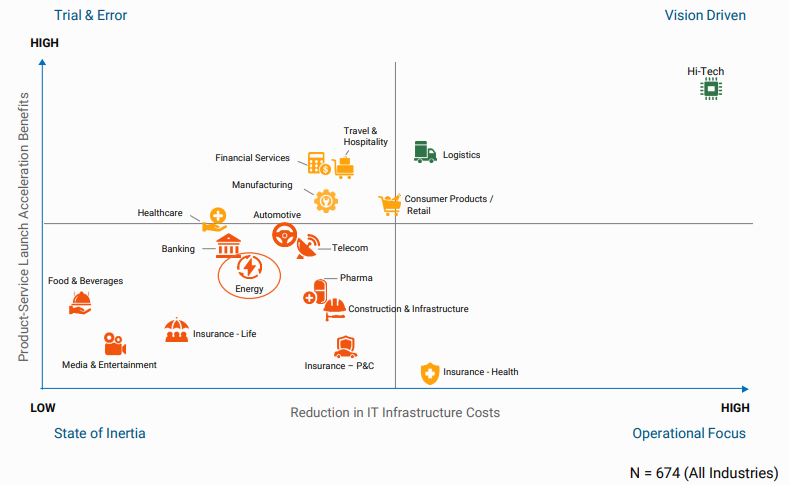

If digitalization is approached in this segmented manner, it will be doomed to fail. Instead, invest in the core capabilities and technological foundations that will beget other digital capabilities. For example, the Trianz report also asked and outlined where different industries stand regarding cloud infrastructure investment:

The energy sector scored low on cloud-based investment, meaning the type of digital transformations that build upon cloud technology (e.g., tracking the customer journey through different devices and pathways, GIS capabilities for utility field workers) won’t even be possible.

Final thoughts

The utility sector is finally shedding its reputation as being stuck in the ways of the past, but as the Trianz report shows, there is still plenty of work to be done in order to keep pace with other industries.

And, while the industry as a whole is not a monolith, there will certainly be innovative companies and programs that are ahead of the curve in embracing digital transformation. The more digital technologies implemented across the grid and for customers (residential, industrial, and commercial alike), the more it will lift the entire industry.

The fact is that utility customers are no longer just comparing their customer experience to other utilities, but rather they’re looking at the seamless digital transformation in a customer’s use of media (e.g., Netflix) or online shopping (e.g., Amazon), and so much more.

With proper investment, cross-department collaboration, and internal goal-setting, utilities will soon be able to leap into the realm of vision-driven industries, a position the sector is certainly capable of reaching