I recently bought a new car. I walked into the dealership, drove one, chose one and gave the nice finance lady my email address. She emailed all the application forms to me and I emailed back my information. She pretended to shop around for a good rate and I pretended to wait patiently.

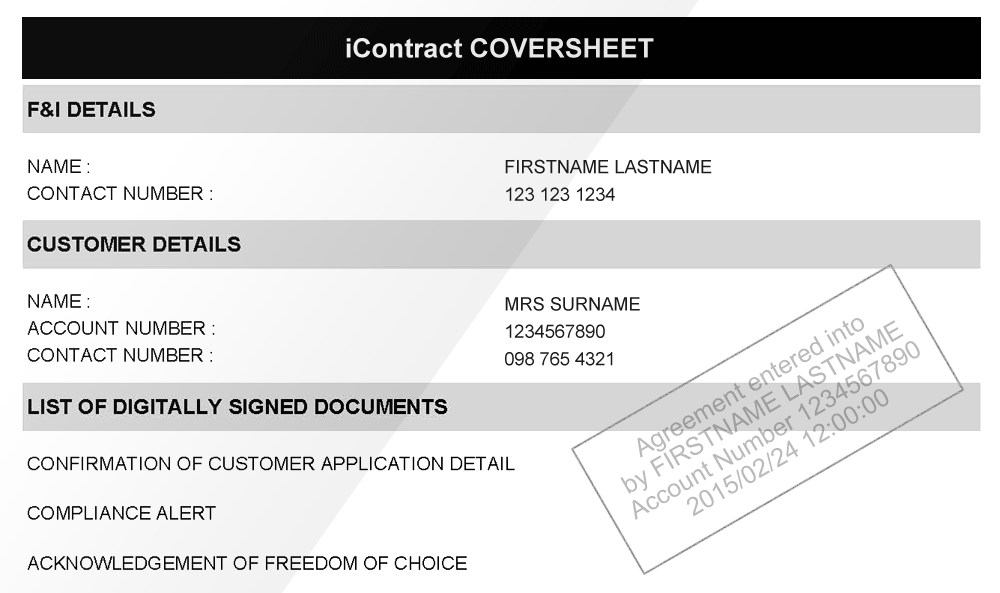

Eventually the deal was finalized and a 12-page document was emailed to me. If I wanted to dispute anything, I could amend the document and send it back to be rectified. Fortunately, it was all correct and all I had to do was type in my full name and click “Accept” a few times.

A few hours later the document was delivered to my inbox as a valid contract between myself and the finance house, detailing an legal and binding agreement between two happy parties.

Why am I happy?

Firstly, I have a shiny new car that smells nice. Secondly, the ease of applying for vehicle finance and having the documents emailed to me meant I didn’t have to drive to the dealership again. I also didn’t have to print out a single piece of paper or scratch around for a black pen to initial and sign on all 12 pages. Of course I’m happy – the whole process was exceptionally convenient for me.

How does electronic acceptance work?

Very simply put – you receive the document by email, you open the PDF, agree with the contents and click on the ‘Accept’ buttons. You don’t even have to download any additional software!

Is it secure?

Yes, it’s actually easier for a fraudster to forge a wet-signature than it is an electronic acceptance. Most people don’t sign their full name in pen, so entering your whole name as well as an identifier like an ID number in the digital process makes it more secure.

Is it legal?

Yes, it’s just as legal as paper and pen. And here’s the clincher… a timestamp authority is captured which can be upheld in a court of law. The timestamp authority can’t be tampered with. It’s a digital certificate capturing and confirming acceptance.

Each country has its own set of requirements with regard to electronic signatures. Three sets of laws regulate electronic signatures for any given transaction under South African law:

- South African common law;

- ECT Act (Electronic Communications and Transactions Act 25 of 2002); and

- Legislation specific to that type of transaction

The Electronic Communications and Transactions Act 25 of 2002 provides for the following definitions:

“electronic signature” means data attached to, incorporated in, or logically associated with other data and which is intended by the user to serve as a signature.

“certification service provider” means a person providing an authentication product or service in the form of a digital certificate attached to, incorporated in or logically associated with a data message.

Section 2 of the ECT Act says that “The objects of this Act are to enable and facilitate electronic communications and transactions in the public interest […]”

The above means you can sign electronically, as long as the process follows the legal requirement.

Legal bit over, let’s get practical.

Do you have enough time in the day to do stuff? No.

Would you like to save time, resource and cost? Yes.

Would you like to reduce your risk of falling victim to fraud? Yes.

Do you want to be kind to the environment? Of course.

Electronic Acceptance. Enough said.

Improve the customer experience with secure document delivery today