When you think of buzz words like ‘innovation’ and positions like ‘Chief Innovation Officer’ you typically associate these with fresh, hip start ups and not your conservative financial institutions. However, banks are actually coming around and spending significant monies on innovation and creating departments dedicated to just that. Why is this?

Banks have to stay relevant in today’s digital world

As the banking customer base of millenials increases and new customer facing technologies from the likes of virtual wallets and others come onto the scene, banks have recognized that they need to get with the program. They have to stay relevant in the digital world, as more and more customers are engaging and consuming information digitally and they prefer to do so.

While many banks in developing markets, such as Brazil and South Africa, continue to invest in new communication technologies and forge ahead as leaders in this arena, many of the developed countries, such as the US, lag behind. If you find your organization in the latter category, where do you begin?

Think about investing in new communication channels

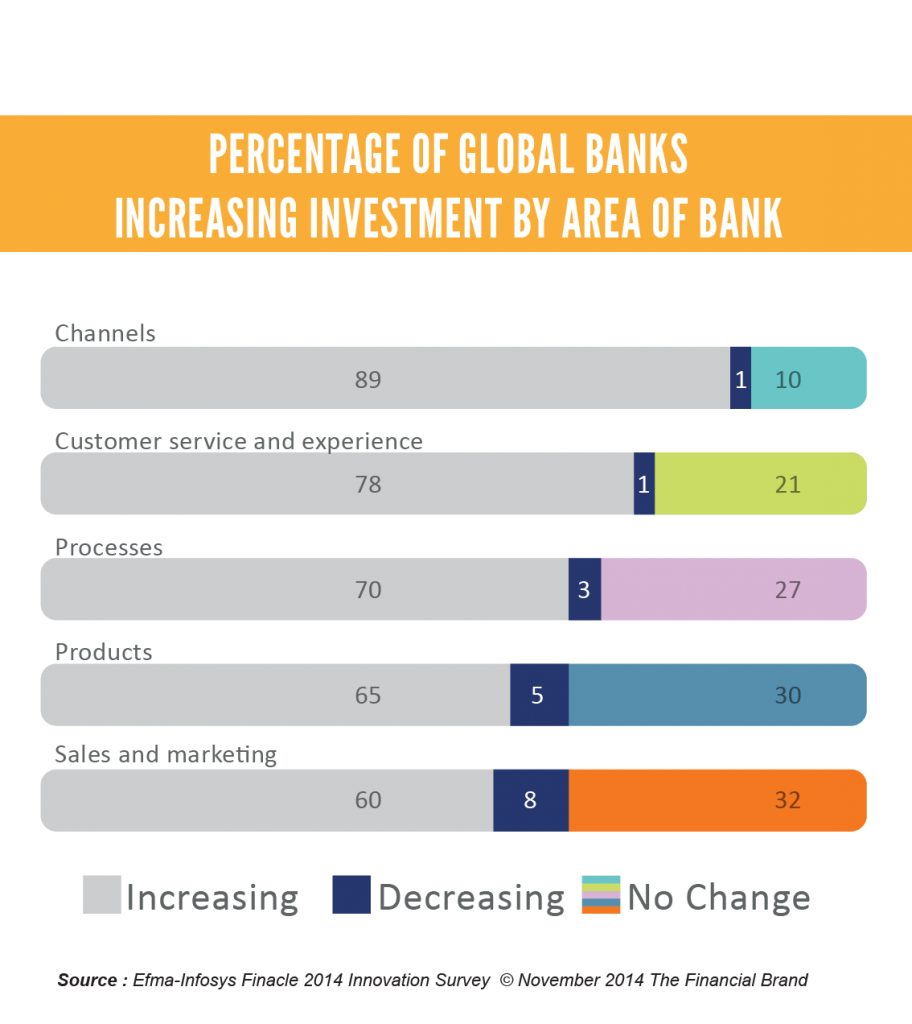

According to the Efma-Infosys Finnacle 2014 Innovations Survey, 89% of banks are increasing their spend on new digital channels.

According to the study, the largest of these channels is mobile, to no surprise. Ask yourself:

- How do you communicate with your customers now? How do you deliver documents, like statements?

- Do you provide your customers with a choice of how they can engage with you and receive these documents?

- Do you have a mobile strategy?

Give customers the choice

As things stand, digital communication is already critical for banking.

Banks cater to customers of different ages, who come from a wide spectrum of backgrounds. Many of those banks will embrace new ways of communicating with their customers, while others would prefer that things didn’t change. But, not adapting to meet the expectations of today’s ever demanding consumers, could be detrimental for business…

A survey by Smart Communications finds that almost two-thirds (63%) of consumers say they would consider switching banking providers, if communications don’t meet their expectations.

Good CX means allowing customers to communicate using the channel of their choice. Importantly, however, it also means being consistent and accessible across all communication channels.

So, the bank’s website and app should have the same tone and feel as the communications it sends out via email, text, and instant messaging.

This level of consistency is especially important when it comes to introducing and helping customers get to grips with any new technologies available to them. Customers are much more likely to accept and embrace a new piece of technology if the communication around it looks and feels familiar.

Most banks have an online banking portal, and apps are a dime a dozen. But what about the customer who doesn’t visit the portal or app to view their full statements or communications? What choice does that customer have?

Deliver documents directly to your customer’s inbox. Innovation through new channels means communicating with your customers in all channels, including that of email.

Secure document delivery via email can be that innovation you have been looking for. Pushing documents as secure attachments through email (PUSH) is a complementary strategy that offers yet another option for your customers. The PUSH channel has become the chosen channel for many retail banks around the world because it is convenient, easy to use and can be accessed on multiple devices.

The advantages of email mobile presentment are clear:

- Customers already use smartphones for email (75% in US & 68% in UK).

- Smartphones come pre-loaded with an email app.

- Presentment is not reliant on website registration (aka username/password). Customers can enroll in eDocuments with one click directly from an introductory email. Thus removing the largest barrier to new enrollment.

Learn more about how banks around the world are now using PUSH to communicate with their customers.

Improve the customer experience with secure document delivery today