The insurance industry has been drowning in paper for many years, but with the rise of the digital era, insurers now have access to new technology and processes to help them go paperless. Moving from paper to digital not only saves costs, but also streamlines business processes, provides more data security (aids in compliance with data privacy regulations).

In the past, insurers have struggled to develop ongoing, long-term customer engagement, due to a lack of focus on the customer experience. Creating a great customer experience relies heavily on communication and transforming how the insurer communicates is key to keeping customers engaged. Now with accelerated sector investment in artificial intelligence (AI), insurers can revolutionize their interaction with customers even further – using big data to create hyper-personalized experiences, a better service and more relevant and timely communication.

The enhanced customer experience of a smart digital document will boost paper turn-off rates and ultimately deliver a significant reduction in customer communication expenses.

See for yourself!

Demo- Short term insurance

Send yourself a sample demo of our smart, secure, interactive Short Term Insurance policy (presented by email or on the web) showcasing how customers can verify and update coverage, view no claims progress and contact their agent, on any device.

Demo - Healthcare

Send yourself a demo of our smart, secure, interactive Healthcare policy showcasing how customers can view claim details, send an appeal and contact their agent, on any device.

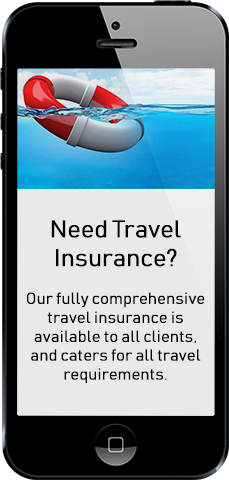

Demo - Mobile screens

Scroll down to view sample screens of an interactive insurance document, viewed on a mobile phone. See consent forms, security screens, transaction details, contact your agent forms and more.

Testimonials

Read testimonials from insurers that have implemented our smart digital policies, statements and other documents.

Resources

Jump to a list of posts, articles and whitepapers on digital communication in insurance and enhancing the customer experience for insurance customers.

Digital communications

Not sure where to start? Jump to a list of all the communications an insurer could migrate to digital, saving communication costs and enhancing the customer experience.

Interactive insurance demo – mobile screens

Demo – Interactive insurance documents

Get an electronic insurance policy sent to your inbox.

The following user features are showcased in the demos:

Demo 1 - Short Term Insurance: Statement - Online

- Cover email with secure PDF attachment

- Open secure statement using password or shared secret

- Interactive, clickable PDF experience

- From the PDF, click through to secure, personalized website experience

- Online statement includes:

- View and download full statement

- Make a payment via credit card, ACH, Mobile or QR code (form submission)

- Set up payment alerts (form submission)

- Submit a new claim (form submission)

- View full policy details

- Update policy details (form submission)

- Download documentation: e.g. full policy wording, Proof of Ownership

- Claims history

- No claims progress

- Payment history

- Contact your agent (form submission)

- Personal Property calculator

- Request a quote (form submission)

Demo 2 - Short Term Insurance: Statement - Email

This demo requires a once off download of the Striata Reader app

- Cover email with secure encrypted EMC attachment

- Striata Reader download instructions

- Open secure statement using password or shared secret

- Interactive, clickable experience (offline)

- Encrypted email statement includes:

- View and download full statement

- Make a payment via credit card, ACH, Mobile or QR code (form submission)

- Set up payment alerts (form submission)

- Submit a new claim (form submission)

- View full policy details

- Update policy details (form submission)

- Download documentation: e.g. full policy wording, Proof of Ownership

- Claims history

- No claims progress

- Payment history

- Contact your agent (form submission)

- Personal Property calculator

- Request a quote (form submission)

Experience it for yourself!

Testimonials

Plymouth Rock

“Plymouth Rock has a long history of identifying innovative ways to deliver outstanding service to our consumers and agents. Eservices are another example of our trying to make our customers lives easier.” – President, Plymouth Rock Assurance (Striata & Speedpay® service client)

Zurich

“I’d like to thank you and your teams for all your efforts over the past 18 months in what has been recognized at senior levels as a very successful project.” – Senior Program Manager, Zurich

Chubb Insurance

“By offering this secure electronic document delivery option for our agents and policyholders, Striata helps Chubb not only save costs, but also provide a more secure and faster way to deliver policies and communicate with customers. At the same time, the Chubb ePolicy service helps us cut down on paper and supports broader corporate initiatives to reduce impact on the environment. ” – eBusiness Project Manager, Chubb Insurance

Keen to find out what we can do for your business?

Resources

Read through some additional great resources, with specific focus on how digital customer communication can improve efficiency, reduce costs and ultimately enhance the customer experience in the financial services industry:

The impact of AI on the insurance industry

The insurance industry is often accused of outdated processes, leaving today’s digital customers frustrated and dissatisfied. However, new technology driven by Artificial Intelligence is set to revolutionize the customer experience by enabling insurers to provide products and service levels that are more aligned with the modern customer’s expectations. In this edition of our Reading Room, we share some great content regarding the impact of AI on the insurance industry.

How AI and Machine Learning are impacting CX in insurance

Emerging technologies, such as artificial intelligence and machine learning are fundamentally changing the way insurers engage with their customers. They enable hyper-personalized experiences that help establish loyalty and drive revenue. In this edition of our Reading Room, we focus on how AI and Machine Learning are driving change in the insurance sector.

Insurers are battling with digital engagement

This is a great document focused on digital challenges in the Insurance industry. Many insurers don’t have a relationship with their customers due to the nature of customer communications in the insurance industry. Also, many insurance interactions are ‘once and done’ each year, the opportunities for the insurer to connect with the policyholder are scarce. Insurers must move away from the ‘cost savings’ mindset when approaching customer communication and focus on the benefits of engaging with customers digitally and tracking their behavior.

Why are insurance customers not digitally engaged

In an age of having everything at our fingertips, where the digital economy is most certainly a reality, insurance companies are struggling to get customers to digitally engage beyond claims. In her latest blog post, Mia Papanicolaou highlights the challenges insurers face in getting customers to foster a digital relationship when insurance is a once off (grudge) purchase and explains why email is a fantastic first step in any digital relationship.

How digital is transforming the customer experience in Insurance

Consumer expectations and digital technologies are driving change in the insurance industry. The future looks bright for insurers who embrace this change, as they have the potential to increase market share and ultimately profits. Read on to discover how digital is changing the customer experience for policyholders; the three pillars that make up the digital insurer and four ways customer technology can disrupt the insurance sector.

Digital Communications

Insurers can transform the relationship with customers through consistent, relevant and useful digital communication across the customer journey, including:

- Welcome and onboarding messages

- Policy documents and endorsements

- Proposal forms

- Cover notes

- Claims tracking

- Monthly bills

- Payment reminders and confirmations

- Past due and collections notices

- Payment confirmation notices

- No Claims certificates

- Proof of Ownership

- Driver Acceptance

- Terms and Conditions