Future generations of kids will be learning about 2020 as the year of rapid digital transformation. Not only did consumers migrate in droves to digital channels, but businesses were forced to suddenly accelerate the digitization of processes and communication in the face of a socially distanced and physically restricted world.

At the same time, a struggling economy has put pressure on marketing spend, and this was evident in financial institutions tightening their budgets. Pre-COVID-19 research by Salesforce didn’t highlight budget as a challenge for marketers. That shifted quickly, once the effects of the pandemic became clearer.

In a subsequent survey by Marketing Week and Econsultancy, 69% of respondents cited “Uncertainty about budgets, planning and events” as their number one challenge.

The shift of marketing spend in banking – Where is it all going now?

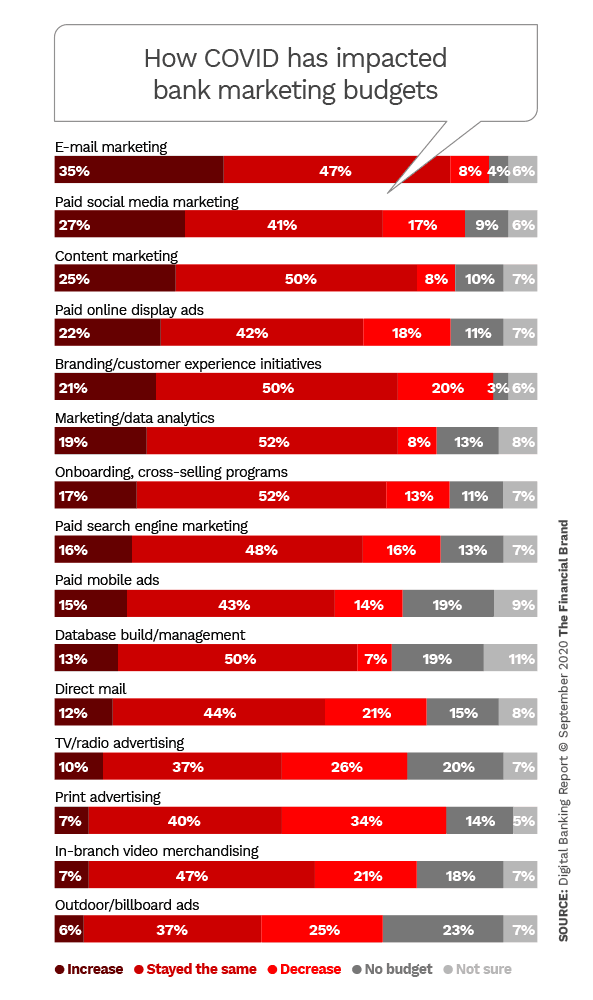

Financial and banking marketers had to shift their focus onto channels that were most likely to reach their target audience. Not surprisingly, 2020 saw marketing spend taken away from media such as outdoor advertising, print advertising, broadcast and in-branch promotions. Whereas, an increase in spend was observed in digital channels like email marketing, social media and content marketing [see Figure].

Email is king – but make sure the king works for you

Customer communication via low cost, digital channels is now more important than ever. But, simply moving various communications from other channels to email is not enough.

Email marketers must focus on creating a great customer experience, while also taking into consideration the uncertainty and stress that is unique to 2020.

Design your campaigns for easy consumption

Emails should be easy to read and understand, regardless of the device or the email client they are being viewed on. Badly designed emails, that do not follow best practices or accessibility guidelines, can frustrate the customer and deter them from engaging with your emails in the future.

Ensure that content is easy to scan, images create an emotional connection to the content, and CTAs are clear and easy to follow.

Change the conversation to be more customer-focused

COVID has also instigated a shift in what consumers value – bringing kindness, community and purpose to the forefront, not only in personal interactions but also in what customers expect from businesses.

What’s more, trust has become one of the most important elements between a company and its customers…

71% say if they perceive that a brand is putting profit over people, they will lose trust in that brand forever (Edelman Trust Barometer).

In this time of shared trauma, customers want to feel a connection with a company, outside of the service they receive. So, instead of including a long list of features, rather highlight how your product/service will benefit them, so they can relate to the content and see that you are addressing their specific needs.

Banks should personalize communications using the customer data they already have

Banks typically have access to a lot of data – about customer behavior, lifecycle stage and purchase history. Use this behavioral data to personalize email messages, not only with the customer’s name, but with content that is relevant and useful based on their circumstances.

Taking it a step further, technologies such as real-time data, artificial intelligence, and prescriptive analytics, have enabled a more hyper-personalized approach to customer communications, where messages are based on a prediction of the customer’s next action.

Remember the basics

While you are implementing the above recommendations, remember to stick to the basic rules and principles of what makes a good email. ‘Make a good first impression’ is applicable here – so think about what the customer sees in their inbox.

The ‘from name’, the subject line and the preheaders all influence how quickly the customer will understand what the email is about, and whether or not it will grab their attention.

Also remember that, in general, people are likely feeling overwhelmed by the events of 2020 and want to simplify their inboxes – make it easy for them to suspend or unsubscribe from your bank’s communications.

While it’s clear that email has prevailed as the channel of choice during COVID-19, marketers must still ensure that their email campaigns resonate with today’s anxious customer in tone, content and intention.

Ross Sibbald

Commercial Director, Africa