The importance of CX in financial services has been undervalued.

The financial services industry continues to experience the highest levels of disruption. This is true in varying degrees across banking, wealth management, payments, insurance and other providers.

Disruption is coming from all sides.

Fintech start-ups have targeted niche services with innovative alternatives. Established big tech companies are leveraging their large customer bases and the trust they have built, to move into financial services. And technologies like blockchain promise to radically change the ‘way things were’. For example, how transactions are authenticated.

Customers are signing up with challenger banks and giving non-traditional financial services companies a chance.

In part because legacy providers haven’t been able to innovate fast enough, leaving the door wide open for disruptors to entice their customers away with a better customer experience.

What customers value in a bank, insurer or asset manager has fundamentally changed.

The question is:

Can an enhanced CX in financial services, help win back the customers they have lost?

A good starting point when embarking on a strategic CX enhancement initiative is to focus on improving digital communication. As relevant and personalized information is vital to delivering a great CX in financial services, it makes sense to start by improving the communications customers already receive.

Table of contents:

Are established FS brands really under threat?

Threats: BigTech, Fintech, Insurtech…

Bigger threat: Cybercrime

How the FS industry rates themselves on digital maturity

Why FS companies must focus on CX

Can FS companies afford to delay CX enhancements?

You can’t build a relationship without communication

What are the first steps to winning back customers?

Are established FS brands really under threat?

Regardless of the type of financial service, customers are attracted to the combination of a strong digital offering, increased transparency and lower costs.

At first, new entrants offering disruptive solutions battled to build enough trust for consumers to jump. Established brands traded on their long history and ‘too big to fail’ status.

But, that’s no longer the case.

A growing rate of dissatisfaction with traditional business models and the availability of trusted alternatives, offering convenient digital services, means customers are jumping ship.

But the rate of customer churn is not necessarily the same across all types of financial services companies.

- Consumer Banking 72%

- Fund Transfers & Payments 54%

- Investment & Wealth Management 36%

- Coommercial Banking (including small & medium enterprise banking) 35%

- Insurance (life and non-life) 25%

- Brokerage Servicess 19%

- Insurance Intermediary 16%

- Market Operators & Exchanges 12%

- Fund Operators 9%

- Investment Banking 7%

- Pension Funds 3%

- Reinsurance 2%

Source: Penetration of Fintech among the US Financial Sector (a sample of 1300 companies) – technorely.com

This graph from Techno Rely shows consumer banking is experiencing the highest level of disruption from fintechs, followed by payments, then investment and wealth management. In fourth place is commercial banking and insurance comes in fifth.

Retail banking

Consumer banking has experienced the most disruption compared to industry peers, not only from fintech entrants but from BigTech challengers too.

Legacy bricks-and-mortar banks have struggled to compete in the new digital landscape, hindered by legacy systems, onerous regulations, and an ‘old-school’ approach.

%

In a survey of UK decision-makers, 82% of those interviewed said banks aren’t innovating fast enough to meet consumer demand for digital services

In South Africa, a region historically dominated by four primary retail banks, increased competition is emanating from emerging banks like Capitec, digital-only challenger banks like Tyme and Bank Zero, as well as established brands like Discovery that are extending their offering to include banking services.

According to a report by PwC entitled Digital disruption in the South African banking sector: “Capitalizing on growing distrust and dissatisfaction with slow-moving legacy banks, digital entrants have focused on building a community of enthusiastic early adopters, often digitally-savvy millennials looking for a banking provider with a ‘fresh’ identity and cleverly differentiated features.”

In the US, a high rate of dissatisfaction is especially evident amongst millennials, the largest economically active group and one that is significant to future sustainability. By 2030, the millennial age group is expected to number 78 million in the US alone.

- One in three millennials in the US are open to switching banks in the next 90 days and a similar proportion believes they will not even need a bank in the future.

- 71% would rather go to the dentist than listen to what banks are saying.

- One third believes they won’t need a bank at all in 5 year’s time.

For great research-based insights into what banking customers really want – read this article by Bain entitled: In Search of Customers Who Love Their Bank

Asset and Wealth Management

Legacy asset and wealth management companies are losing investable assets to disruptors. New technology in the hands of innovative thinkers, means more transparency, lower costs, and better engagement through digital services.

In a 2016 article on digital disruption in wealth management, McKinsey states “the most aggressive projections have digital challengers achieving 5% of industry assets by 2020”. This may not seem like a significant percentage, but in 2020, total investable assets are estimated to be $102 trillion. If these projections are true, then digital challengers are currently managing $5.1 trillion in assets.

But, can established wealth management companies get ahead of evolving customer expectations?

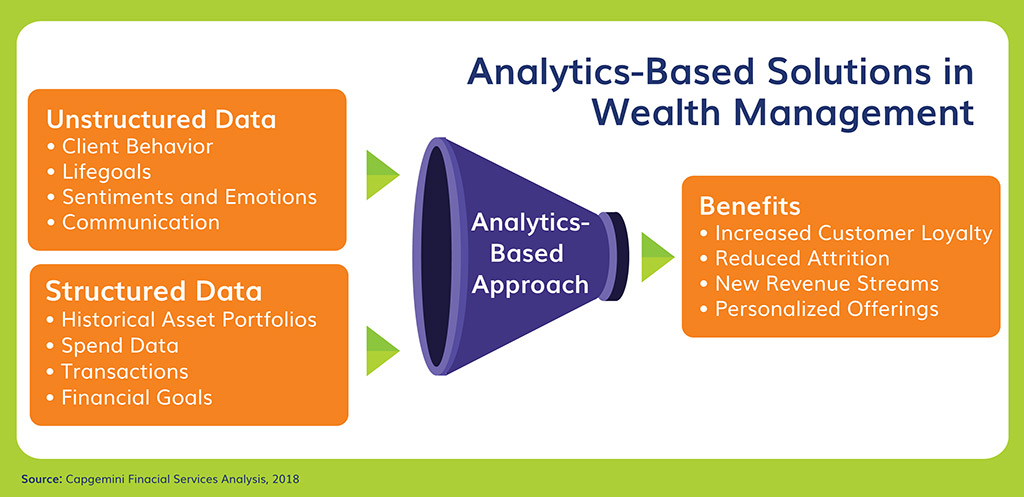

According to Capgemini’s Top-10 Trends in Wealth Management, companies need to take a BigTech approach to ensure they address changing customer demands. To do this, wealth management firms need to embrace data and analytics to extract deep customer insights.

Payment

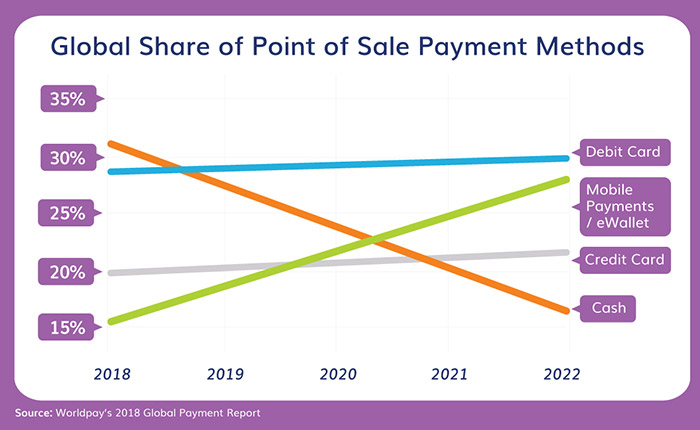

The payment industry has gone from being dominated by large banks and credit card providers, to what one article calls “a dizzying onslaught of challenges”.

New entrants are offering payments at a lower cost, through more convenient channels.

There are so many payment options: Voice-enabled payments through Alexa and Google Home; person-to-person payments via Zella and Venmo; pass-through digital wallets like Apple Pay and Google Pay, private-label wallets like Starbucks; “tap-and-go” payments and the list goes on.

%

China has been leading the global switch to cashless payments. According to the China Internet Watch, mobile payment users have reached a penetration of 95.1% – almost at saturation point. In addition, 40% of in-person payments are done using a digital wallet.

High adoption rates of new payment methods by millennials is a significant threat to incumbents. In a report by PwC, it was found that the use of mobile payments in-store – via smartphones and wearables – by millennials, was more than double the rate measured across all consumers. ~ The Financial Brand

Mobile Payments – interesting facts

- Global use of mobile payments forecast to increase to 28% in 2022 – will surpass credit cards and cash.

- More than 45.2% of China’s huge population is already using eWallets to make payments.

- China’s mobile payments market was worth roughly 35 times the US market (2017)

- 89% of consumers in the US still shun mobile payments in favor of cash, credit or debit card.

- The most popular mobile app in the US is Starbucks (private label), but Apple Pay is catching up fast.

- 92% Of millennials in Europe expect to use mobile payments by 2020.

- 65% Of Gen Z (16-20 year-olds) in the UK think they will use mobile payments more than cards by 2022.

Insurance

The insurance industry was characteristically slow to respond to disruption. New entrants came in offering highly personalized products and services, supported by relevant, easy to understand and contextual information – instantly on hand, via any channel they choose.

Insurers recognized the threat and are now outspending other industries to bring on technologies that will improve and exceed the customer experience their policyholders expect.

A personalized customer approach is still fairly new in insurance, but the companies that are getting it right have lowered acquisition costs, increased customer satisfaction, and gained a corresponding competitive advantage. ~ PwC

Research has found that “insurers who reinvent the customer experience and drive human-machine collaboration are achieving returns in excess of 10 times their investment and could increase industry-wide profitability by between $10.4 billion and $20.8 billion.”

Want to know more about the adoption of artificial intelligence in insurance? Get our Whitepaper entitled: Insurers will not survive if they don’t fundamentally embrace AI.

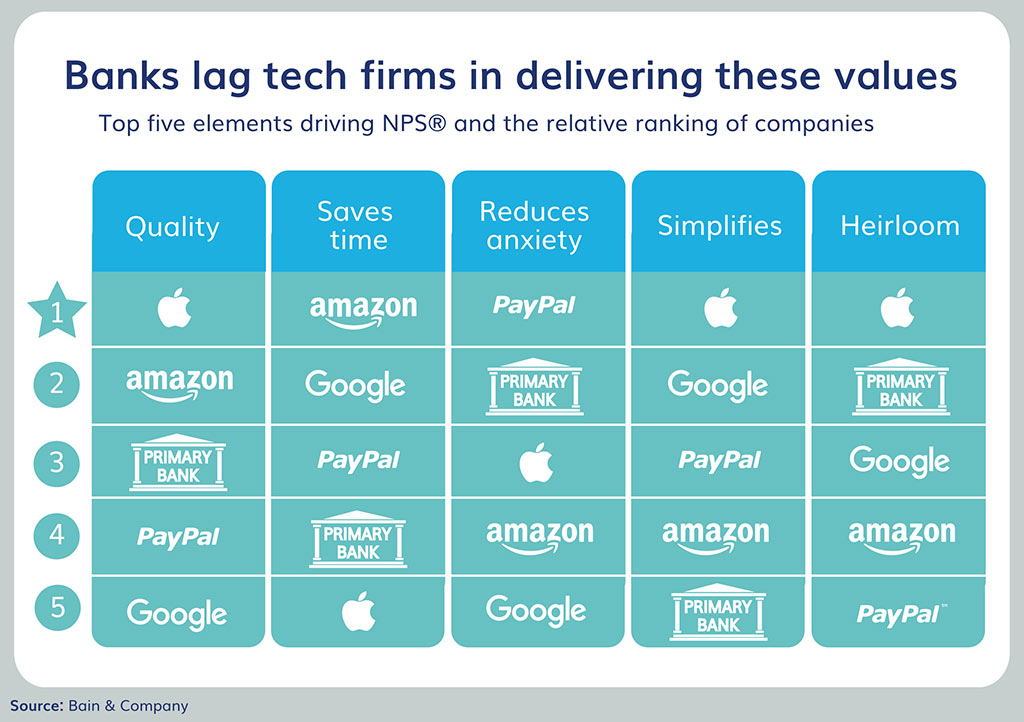

Many of these firms excel at easy, simple, high-quality digital—increasingly, mobile—interactions that consumers demand. Besides their digital expertise, technology firms are marching into financial services on the strength of consumer trust. ~ Bain

Threats: BigTech, Fintech, Insurtech . . .

Technology firms such as Amazon, Apple, Facebook, and Google have a massive advantage when it comes to launching into additional services, such as payments, banking, credit and insurance.

Why the big advantage?

A large customer base and a high level of financial trust.

Google and Apple have already launched a payment offering and Amazon is not far behind. It’s not just American firms that are a threat to the ‘way things were’ – Alibaba’s AliPay and Tencent’s WeChat Pay from China, have captured a massive share of their local markets and could potentially disrupt markets outside their region.

BigTech companies are also successfully capturing emerging markets, where traditional financial services have failed to find a decent foothold. In Africa, it’s the mobile network providers that have combined their large budgets and customer bases with innovative technology, in order to provide financial services.

Africa’s flagship mobile money provider, M-Pesa, processes over 1.7-billion transactions a year, which accounts for more than 50% of Kenya’s GDP value, according to an article by Forbes.

It’s a matter of trust . . .

In a study by Bain, respondents were asked about their levels of trust in various companies.

29% Said they trust at least one tech company more than their primary bank and 54% trust one tech company more than banks in general.

In a separate report, Bain found that across the five elements that drive Net Promoter Score (NPS) – a BigTech firm outperformed the respondent’s primary bank in all categories.

What’s more:

In a survey, also conducted by Bain, of Amazon Prime customers, 65% said they would be willing to try a free online bank account offered by Amazon. More alarming for incumbent banks, is that amongst customers who don’t buy through Amazon, 37% would give a free online bank account a try.

Those pesky little FinTech companies that appeared less than a decade ago have not gone away, as many in the banking industry had hoped. On the contrary. Many have matured into formidable rivals for customers and the cash they bring to the table. ~ Techno Rely

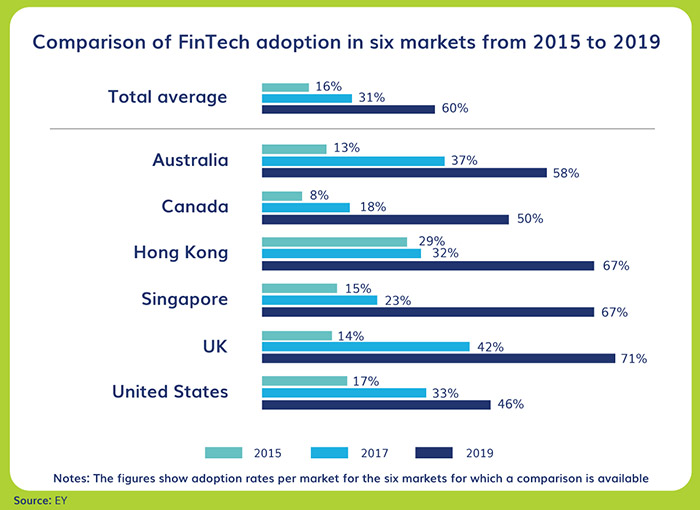

According to EY’s Global FinTech Adoption Index 2019, Fintech challengers have evolved from startups and disruptors into sophisticated competitors, with an increasingly global reach.

They estimated the global adoption rate in 2019 to be 64%, due in part to the fact that incumbent banks, insurers, and stockbrokers have partnered, acquired or developed Fintech solutions to remain competitive.

Bigger threat: Cybercrime

Perhaps an even greater threat to legacy companies who are battling to get their heads around the new digital landscape, is the exponential growth in cybercrime targeting the FS industry

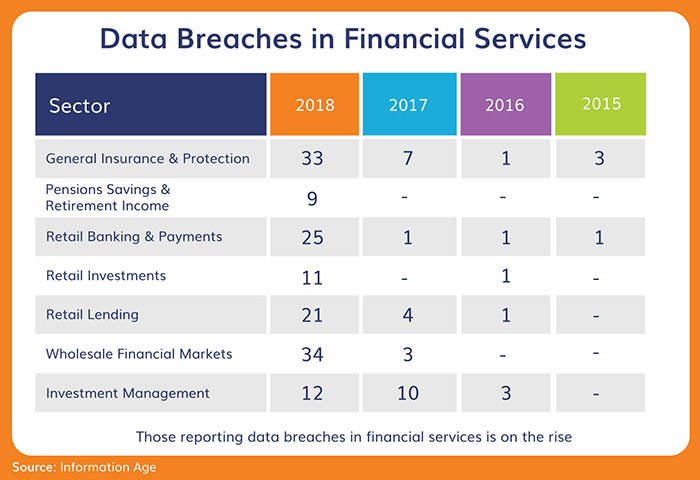

Significant increase in the number of data breaches reported by UK financial services firms to the Financial Conduct Authority (FCA) in 2017 vs 2018.

- The total number of data breaches increased from 25 to 145.

- Retail banks experienced the highest increase.

- The number of data breaches reported by insurers increased from 7 to 33.

- Wholesale financial markets firms reported the highest number of data breaches, narrowly beating insurance.

And these are just the breaches that have been reported to the FCA.

Digital technologies are not just a catalyst for the growth in cybercrime, some – like artificial intelligence, advanced analytics, and blockchain – are also the solution.

But, these technologies are not yet embedded in the majority of financial services companies. According to a report published by Accenture and the Ponemon Institute: “ . . . few financial firms have invested in automation, artificial intelligence (AI) and machine learning (34 percent); or cyber analytics and user behavior analytics (24 percent). Yet, when fully deployed, these technologies deliver the most bang for the buck. Automation, AI and machine learning saved over $4 million in 2018. Cyber and user behavior analytics tools saved $2.7 million.”

For an in-depth read on the use of AI in financial services, this Pinsent Masons report entitled AI in Financial Services – Impact on the Customer, is extremely thorough.

How the FS industry rates themselves on digital maturity

Players within the FS industry see themselves at different levels of digital transformation.

In a report by eConsultancy and Adobe on financial services trends (2019) – well under 10% of respondents said they were ‘very advanced’ in terms of CX maturity, with retail banking being the highest at only 9%.

Less than half rated themselves ‘quite advanced’ with banking (49%) and insurance (46%) leading the way, and wealth and asset management (34%) lagging behind.

Not surprisingly, wealth and asset management respondents rated themselves mostly ‘not very advanced’ at 52% and ‘haven’t even started’ at 11%.

The above numbers show that the door remains wide open for alternative providers to entice customers away from established brands with the offer of a better customer experience.

Why CX in financial services must be a core focus

Improving CX in financial services companies is vital to stop customers from moving across to alternate providers, and win back those that have already jumped ship.

Customers today aren’t interested in how established a brand is or whether it has a long history. They don’t want to go to a branch or meet with an agent or broker.

What they do want, is easy access to services, via the channel of their choice, at the moment they need to interact.

At the very least, today’s consumers expect to receive offers and communications that are personalized to their individual circumstances.

Knowing that competition for customers in this sector will continue to increase in intensity, it makes sense for companies to focus on what customers want, and deliver on that experience.

Can FS companies afford to delay CX enhancements?

Financial services companies that are slow to react to customer expectations when it comes to CX will suffer the consequences.

Disruptors will persist in pushing the boundaries, changing the rules and gaining customers. More aggressive established brands will acquire, build or partner with digital technology innovators to enhance their offering.

In addition:

All the players in the ecosystem will continue to focus on reducing the friction associated with changing providers, by developing tools that make switching services seamless and painless.

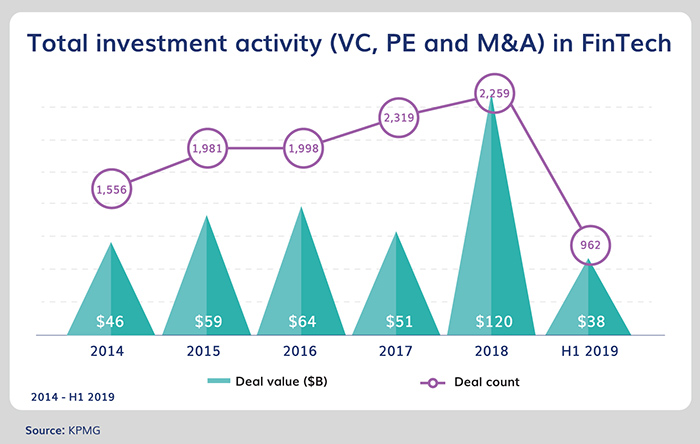

Growth in fintech investment

One way of projecting the level of competition that will come from fintech innovation is to look at how much investment is taking place in this sector.

It’s an alarming picture for FS companies that fail to improve CX:

Global investment in fintech companies reached a record $112 billion in 2018, having been boosted by three massively significant deals. This not only provides more capital to smaller, more agile tech companies but also indicates that large companies are ramping up their investments in fintech firms.

In the first half of 2019:

- Global investment in fintech companies reached $38 billion – down from the previous year due to huge deals not yet closed.

- Investment in Europe reached $13.2 billion, with 7 of the 10 deals being in the UK, but the largest two deals coming out of Germany and France.

- In the Americas, investment reached $21 billion with 7 deals in the US, 2 of the top deals coming out of Canada and a significant deal closing in Argentina.

- In AsiaPac – $3.6 billion was invested in fintech companies.

Source ~ KPMG

You can’t build a relationship without communication

There’s a very good reason why digital communication plays a key role in enhancing the customer experience: Consistent, useful communication provides a strong foundation on which to build engagement, and ultimately a better relationship with customers.

Relevant and personalized information is vital to delivering a great CX in financial services. Digital communication provides the opportunity for a company to engage via the terms and channels the customer prefers.

In today’s digital world – there are five technological capabilities that need to be part of a CX strategy.

5 Technological capabilities that need to be part of a CX strategy:

A path to a single view of the customer

A single view of the customer means making all data about an individual available for other systems to customize that customer’s interaction with the company. This is important, not to know what a customer has done in the past, but to predict what a customer will need in the future.

Access to big data

External sources of data are valuable in growing and refining the shape of the customer. These sources will be either structured data that’s already been filtered for a purpose or raw, unstructured data.

A data analytics tool

It’s imperative to have an analytics tool that can consume available data to provide insights into customer behavior in real-time. This information is vital for two key reasons: to measure the performance of each communication against set metrics and to continually refine and improve what you know about the customer.

An AI smart decisioning tool

An AI-based decisioning tool will leapfrog your communication from personalized to hyper-personalized, by predicting user behavior and providing content based on that prediction to prompt the user’s next action.

A multichannel digital communication platform

Ultimately, designing the perfect message is of no value if you can’t deliver that message to the customer. Part of the required architecture is a messaging platform that can deliver messages across digital channels and feed engagement data back into the process.

5 Goals to aim for in a CX strategy:

Don’t wait until you have everything in place – it makes sense to start by improving the communications customers already receive.

Here are five areas to focus on to kickstart your CX enhancement strategy:

Personalization

Use the data you have to personalize communication, based on the channel, time and tone that is best for each customer. Something as simple as asking the customer for their preferred communication channel can immediately make the experience more personal.

Want to know more? Here’s a vlog on how to Maximize customer engagement with hyper-personalization

Engagement tracking

Track and record customer engagement with each communication in order to refine the customer view. Whether a message was delivered, opened and clicked on, should all be fed back into the smart decisioning tool Want to know more? Watch part 4 of our vlog series: Good email testing & reporting strategies

AI-powered hyper-personalization

An AI decisioning tool can use the data you are gathering to learn about the customer, with the goal of predicting future customer journeys and providing the next best offer for each customer.

Want to know more? Read how AI powered customer communications can boost customer experience

Integrate into the new tools that customers like using

It pays to engage where your customer spends time. Integrating new tools such as voice tech (Siri, Alexa, Google Home) and chatbots, positions the company as a leader in customer engagement, and improves the customer experience.

Want to know more? Read this blog on: Can AI-powered communications improve insurance touch-points?

Data privacy and compliance

Considering that so much of CX relies on tracking, recording, and processing accurate customer data, it is vital to ensure you have the right resources responsible for managing data protection.

Want to know more? Read our insight newsletter: GDPR – your business may be affected

Fortunately, new technologies are changing the relationship with policyholders, by enabling a continuous cycle of interactions. This goes far beyond a claims submission or annual renewal notice.

What are the first steps to winning back customers?

A good starting point when embarking on a strategic CX enhancement initiative is to focus on improving digital communication across one customer journey:

Step 1 – Select a customer journey as your starting point

- Describe the selected customer journey in detail, including all customer touchpoints

- Identify the digital communication that customers are already receiving as part of that journey

Step 2 – Understand available sources of data

- Identify the sources of data that are available to your process

Step 3 – Define the ideal customer journey

- Craft an enhanced customer journey

Step 4 – Complete a gap analysis

- Identify what communications would need to be added to achieve the ideal customer journey

- Describe the data you would need to access to support the desired communications

While the above are necessary starting steps, it’s important to keep your eye on the goal:

- Deliver hyper-personalized messages that contain the next best offer or action, specific to each customer, based on their unique data criteria.

- Augment your emails with AI-powered elements such as chatbot screens and real-time offers, using dynamic content

Frequently Asked Questions

How to improve CX in financial services

Improving CX in financial services requires a focus on identifying what customers want, and building the capacity to deliver on that experience. Customers are looking for, among other things, a strong digital offering and increased transparency from their financial services provider – be it a bank, insurer or wealth management company.

A good starting point when looking to improve CX in financial services is to focus on enhancing digital communication.

Providing regular, relevant and personalized information is vital to building a relationship based on trust.

How to improve customer experience in financial services

Improving the customer experience in financial services requires a focus on identifying what customers want, and building the capacity to deliver on that experience. Customers are looking for, among other things, a strong digital offering and increased transparency from their financial services provider – be it a bank, insurer or wealth management company.

A good starting point when looking to improve customer experience in financial services is to focus on enhancing digital communication. Providing regular, relevant and personalized information is vital to building a relationship based on trust.