Digital communication for utilities – can it fix a fractured CX?

In the past, utilities in the U.S. were not particularly focused on improving their customer experience (CX).

Somewhat unthreatened, as they were the only supplier in a particular area, utilities tended to invest more in technologies to support their infrastructure. And priority was given to projects that reduced operational costs, rather than those that enhanced CX.

Now, exposure to other industries has changed customer expectations. With more choice, and loads of information to help make the right one, the power has shifted firmly into the hands of the utility customer.

CX in utilities can no longer be ignored

Utilities need to invest in technologies and processes that enhance customer experience in order to actively manage customer retention.

This article looks at digital disruption in the utility space; why CX is such an important investment; and how digital communication can fix the bill-to-payment customer journey.

Table of contents:

Digital disruption continues in the utility sector

Customer experience is key to staying competitive

Which customer journey to focus on?

Why it’s vital to ensure a fracture free bill-to-payment CX

What should utilities do to improve CX?

What’s the cost of doing nothing?

How our digital communication solutions can improve your billing-to-payment CX

Digital disruption continues in the utility sector

Despite some monopolistic elements, the utility sector has not been immune to disruption, digital or otherwise.

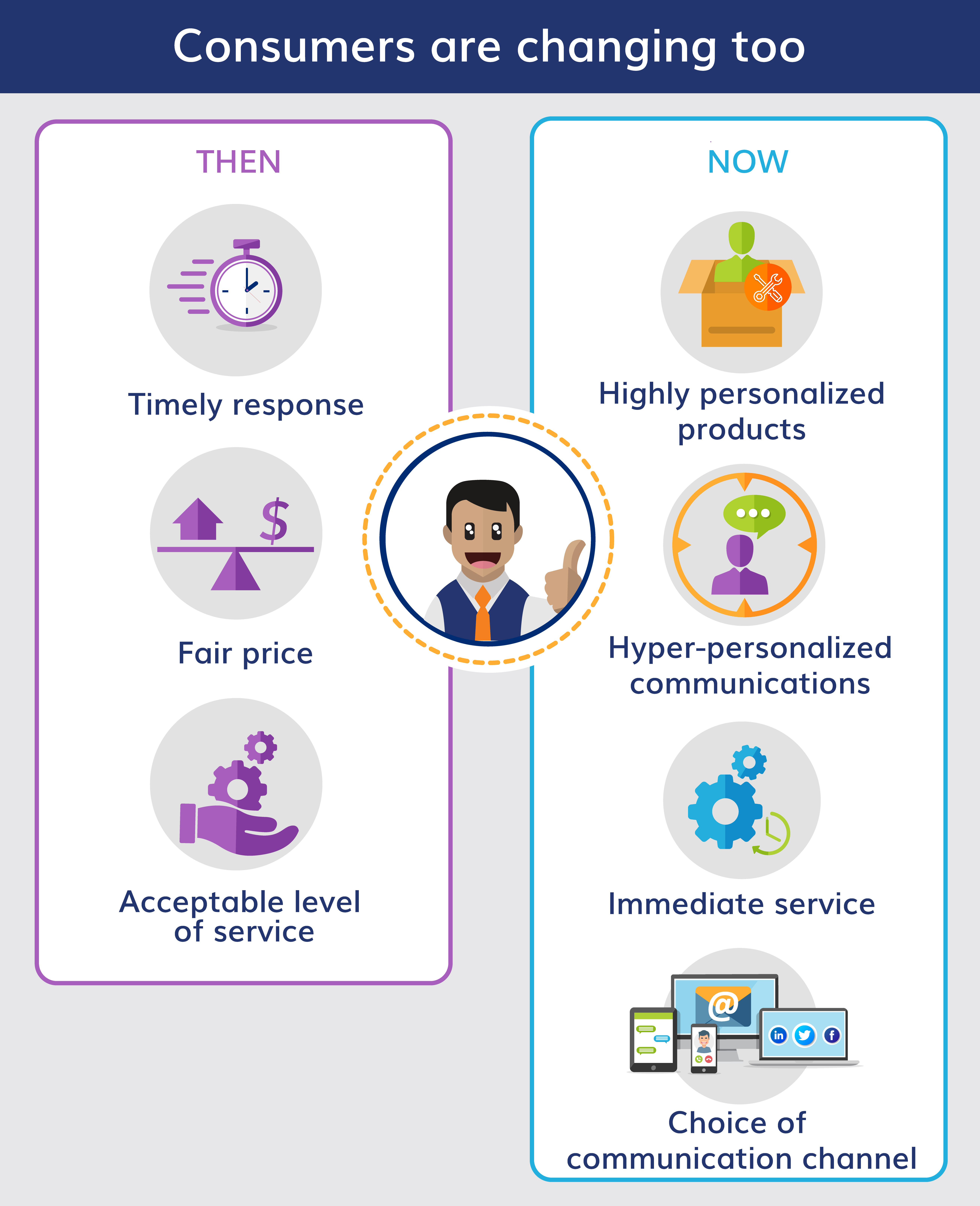

Utility customers have typically had low expectations: keep the lights/water/gas on, offer a reasonable cost and provide an ‘okay’ level of customer service. Customers will tolerate mediocre customer experience when there is only one option.

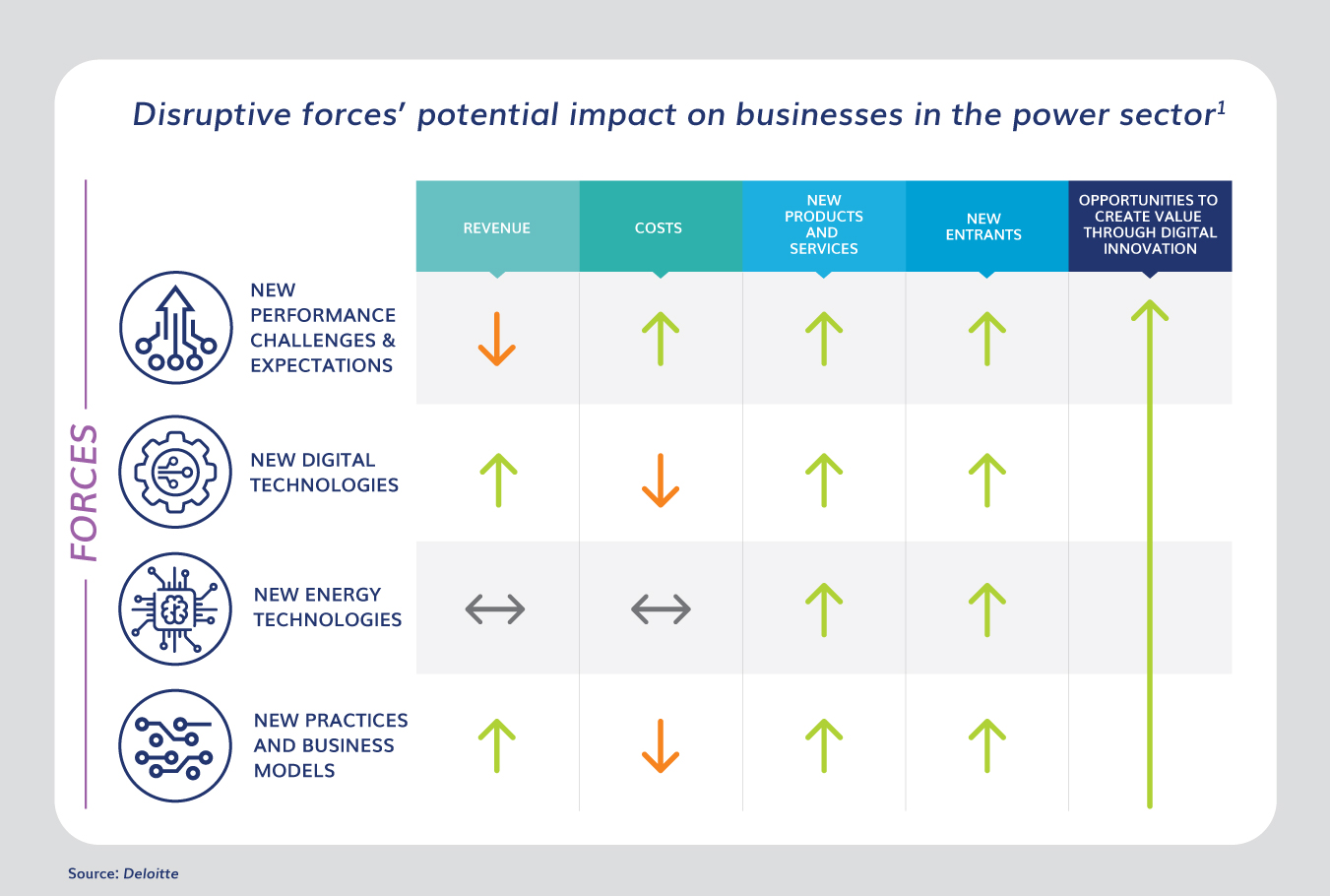

But, market disruption has brought about alternative products and services – some from non-traditional market entrants.

The real opportunities, however, lie in creating value through digital innovation.

Referenced in an article published on Smart Energy entitled: The 6 priorities for utility CIOs in the age of digital utilities, is a quote from Deloitte, which sums it up perfectly:

“Digital is the pervasive thread through all of these disruptive forces – as a catalyst, a disruptor, and an enabler” ~ Deloitte

Customer expectations are changing

Certainly, the profile of a customer that is purchasing and consuming utility services has fundamentally changed.

Today’s ‘digital natives’ are looking for personalized services and customized products. They expect to get information immediately and through whichever channel and device they happen to be using.

What’s more, they want self-service options that are quick and easy to use.

As it turns out, customers are willing to pay for what they want.

In a 2017 CapGemini study, as much as 73% of respondents said they would pay for better customer service from their utility provider.

Retail giants are setting the bar on CX

Customer experience is no longer measured against other utility providers. Innovation in other industries has exposed consumers to the customer experience they now expect across the board.

A great customer experience, from an online retailer like Amazon, for example, sets the bar for all service providers, regardless of how digitally evolved the sector is.

Utility customers used to be satisfied with an ‘okay’ level of service, as long as the price was right and they eventually got a response.

But ‘okay’ is no longer good enough.

Utility customers want an experience similar to what they get from the best brands, across any industry, such as:

- Cross-channel personalized experiences

- Seamless, consistent and connected journeys

- Accuracy, protection and privacy of personal data

- Interaction where, when and how they want

- Value exchanges above and beyond

- Real-time interactions and responses

New competitors are emerging

In addition to benchmarking against the best in other industries, there’s also competition from emerging, non-traditional competitors who design their business with a customer-centric approach from the start.

These competitors offer innovative products, provide integrated omnichannel service options and have implemented modern technology to support their future vision.

This puts further pressure on traditional utilities to improve relationships, or risk losing their customers.

Utilities are starting to realize that customer lifetime value is something they need to actively manage. To maximize the value of a customer, utilities need to understand what their customers really want and map their strategy to provide just that.

“Customer retention is no longer just a question of reliability and cost; it is now a question of providing options, being connected, and allowing customers more control over their energy use.” ~ Deloitte

Did you know: The International Energy Agency projects that 40% of the planet’s energy will be renewable by 2040.

Read more in this article: These Are the World’s Top Renewable Energy Companies

Technology is evolving

An analysis by Frost & Sullivan cited on Big Data Made Simple reveals that big data, predictive analytics, artificial intelligence (AI) and the Internet of Things (IoT) are sparking interest in the utility sector.

Want to read more? Have a look at this infographic on The Impact of AI on Energy and Utilities 2018.

AI will not only play a significant role in how utilities manage demand, renewable energy, and infrastructure, but it will also help them understand consumer behavior and optimize engagement.

Utility providers need to leverage emerging technologies to drive engagement, build better relationships, increase the perception of personal value and ultimately improve customer experience.

An article, by Greenbird, suggests that utilities must ‘become technology companies’ dealing in the currency of data.

“Utilities have to change both their mindset and operating model to foster innovation. ‘Data is the new electricity’ means utilities must become technology companies.” ~ Greenbird

Customer experience is key to staying competitive

Customer experience (CX) is key to being competitive in today’s market, after having superseded product and price in importance, long ago.

Research shows that customer engagement is now receiving both the financial investment and the strategic priority that it deserves. This is supported by a survey that assessed the relative level of maturity of utilities across a range of customer experience best-practices.

Greentech Media Research and EnergySavvy published the findings of the survey as an eBook entitled The State of the Utility Customer Experience, which is well worth a read.

Customer engagement was mentioned by the majority of respondents as the top investment area.

What are utilities investing in as they prepare for changes at the grid edge?

(% of respondents)

- Customer engagement 62%

- Regulator engagement 60%

- Technology and R&D 53%

- Partnerships 42%

- Workforce 21%

- Other 10%

Source – Annual survey report: Mastering the Utility Sales Cycle, Greentech Media, Bentham Paulos, 2017

“Utility personnel today believe that investment in customer engagement is the #1 driver in achieving future business objectives.”

What do utility customers want?

It’s clear that customers want digital communication.

According to a 2016 study by Market Strategies, 54% of residential customers preferred digital communication over any other form of communication.

From the customer’s perspective, the most important communications they receive are confirmations of transactions they have made, followed by their account summaries (bills and statements).

%

Transactional Confirmation

%

Account Summaries

%

News Alerts

%

Newsletters

%

Promotions

Source – Borrel Associates Inc, Merkle Inc.

It makes sense to offer paperless alternatives, such as electronic bills and payment methods because that’s what customers want. In a 2018 Consumer Survey by Chartwell, 59% of consumers agreed that their power company should send them a bill by email.

Customers expect to engage digitally with their utility provider and they want to do just that. According to Accenture, 60% of energy consumers say they would use a simple and intuitive mobile app from their energy provider.

For more on this – here’s a quick read from Energy Central on What Do Utility Customers Really Want.

How utilities can achieve a fracture free bill-to-payment experience & improved cash flow

Which customer journey to focus on?

While some parts of customer engagement may have been modernized, other customer journeys are yet to be overhauled.

One of these is the billing-to-payment process.

Despite the bill, payment process, and collections notices making up a significant portion of the regular touchpoints with a customer, seldom is this addressed as a cohesive customer journey.

Unfortunately:

In past efforts to cut costs, utilities may have campaigned to move customers to a paperless bill. But the digital engagement stopped there. Other important communications, such as payment reminders and past-due or collections notices, continued on paper.

The result: a fractured digital experience.

When cost reduction is the primary driver for going paperless, the customer experience is often neglected, resulting in a fractured CX. In a recurring process such as billing, payment, and collections, this makes for a negative customer experience that is repeated every billing cycle.

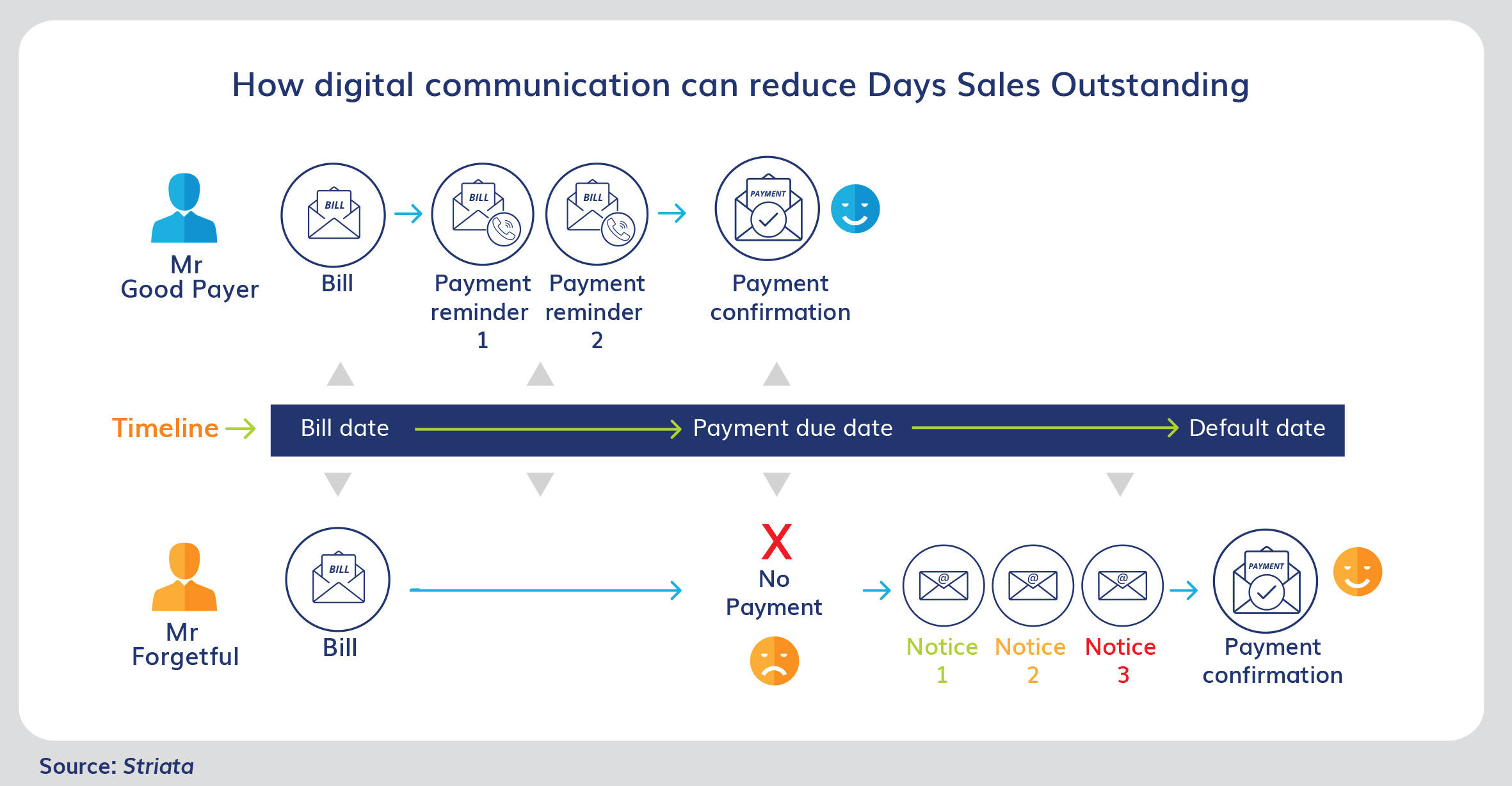

Utilities can’t afford to neglect the journey a customer goes through, from the point of receiving a bill to when they settle the amount due. The experience needs to remain consistent, even when the customer misses a payment and collections notices are required.

Why it’s vital to ensure a fracture free bill-to-payment CX

Why is it so important to offer a streamlined billing-to-payment experience?

The short answer is – cash flow.

When customers have a bad experience, they typically engage less, take longer to pay bills and ignore payment reminders and past due notices.

By repeatedly subjecting the customers to a negative bill-to-payment experience, the utility is effectively obstructing its own cash flow.

The components of the bill-to-payment journey need to be streamlined to remove the friction points that cause a fractured customer experience. For example, friction is caused by forcing customers to receive their bill via a particular channel, rather than one of their choice.

What should utilities do to improve CX?

Utility providers need to focus on digitally transforming the bill-to-payment journey into one that enhances the customer experience.

A great CX will drive engagement, build better relationships and increase the perception of personal value.

Utilities must shift to a customer centric bill-to-payment process and aim to deliver value at each step.

Enhancing customer communication has benefits

Utilities need to change the way they communicate with their customers during the bill-to-payment journey.

Something as simple as knowing a customer’s preferred channel of digital communication for a particular message or task, goes a long way. Customers want a personalized experience and are far more likely to engage when they feel they are getting one.

Manage cash-flow by encouraging payment before default

Utility providers have an advantage when it comes to dealing with defaulting customers – they can simply disconnect the service. When a household or business is without water, electricity or gas, it’s a big incentive to settle outstanding amounts.

But, having a customer default on a payment is bad news for everyone. Sometimes, customers don’t mean to skip a payment. They might be ill, or traveling, or writing the check genuinely slipped their mind.

To begin official collections procedures is burdensome for utilities too. There’s the expense of the process itself, as well as dealing with unhappy (and cold!) customers and managing reconnection processes.

Move utility collection notices to a digital channel. It’s a better customer experience and helps to reduce the friction associated with past-due collection notices.

While each supplier may have different procedures around disconnecting customers, it makes sense to do everything possible to encourage payment prior to the default date and the cut off of services.

In 2017, electricity supply to more than 900,000 homes in Texas were cut off because of unpaid bills, almost triple the number, 10 years before that. In California in 2016, it was 714,000, the highest on record to date [in that state]. ~ Bloomberg

In some states, and under certain circumstances, utilities are not permitted by law to disconnect defaulted customers. Which makes optimizing collections processes even more critical.

What’s the cost of not paying attention to the customer journey?

Any business is at risk of losing customers if they do not keep up with competitive forces and evolving customer expectations.

When it comes to the bill-to-payment process – there are major impacts of not paying attention to the customer journey:

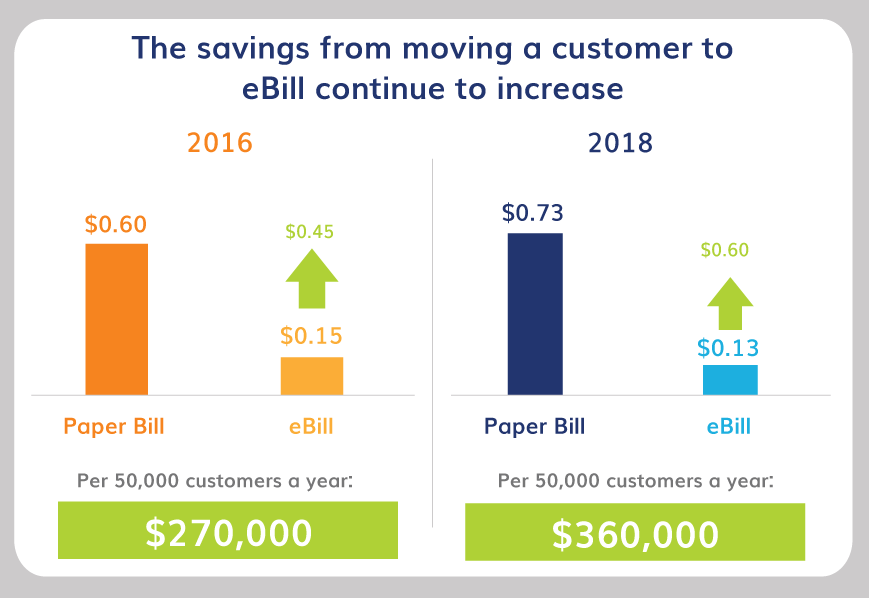

UNNECESSARILY HIGH COSTS:

Due to the comparatively high cost of print communication (bills and collections notices), not maximizing the adoption of paperless processes puts unnecessary pressure on operational costs.

Source: 2018 Chartwell Billing Survey

MISSING OUT ON OTHER BENEFITS:

Paperless processes, such as email billing and collections notices provide opportunities to further streamline other processes. For example, offering a one-click payment option directly from the bill or notice is proven to reduce DSO and improve cash flow.

By offering customers the ability to make a one-click payment from an email bill, you can expect at least 50% of those payments to arrive within 1-3 days.

LAGGING IN CUSTOMER SERVICE:

Customers want a personalized experience with customized services and products and are willing to pay more for it. Not responding to this demand will result in customer churn.

In a 2017 CapGemini study, as much as 73% of respondents said they would pay for better customer service from their utility provider.

UNCOMPETITIVE:

Other sectors are setting the bar in digital customer experiences. If utilities do not commit to digital transformation, other entrants will disrupt the market and entice customers to switch.

According to IDC (2017), non-utility companies and digital disruptors will seize 20% of the energy retail market by 2020. ~ IDC

How our digital communication solutions can improve your billing-to-payment CX

We can help you shift your bill-to-payment process to one that is customer-centric and value-driven.

Our process is simple:

- Offer customers the convenience of receiving an eBill

- Let customers make a payment directly from the eBill

- Send digital past due notices and early-stage collections notices prior to the default date

- Let customers make a payment directly from the collections notice

Experience it for yourself! Get a demo eBill with loads of interactive functionality sent to your inbox.

Together, we can achieve significant benefits

- Moving previously paper-based processes to digital, saves costs associated with paper, printing, and postage ($0.50 per eBill!).

- Providing an eBill option will reduce days sales outstanding (DSO) by between 3 – 7 days.

- Adding a one-click payment process from the eBill results in faster payments and further improved DSO.

- Delivering payment reminders, past-due notices and collections notices by email reduces the number of customers that default on a payment.

- Sending digital collections notices prior to the official process helps to avoid collections agency fees.

When sent digital collections notices, people are 12% more likely to pay in early delinquency than when receiving paper notices, and 30% more likely to pay should it reach late delinquency – McKinsey

Achieve higher than average paperless adoption

Despite the many benefits, large portions of utility customers have not opted for digital billing, preferring to continue receiving paper bills.

Average paperless adoption rates for U.S. utilities have stagnated between 15% and 20%, with the top performers achieving up to 30%.

Paperless adoption rates

%

Industry average

%

Striata clients

Get the Infographic: Paperless Adoption In Utilities Billing