I read an interesting article recently about Barclays Bank staff in the UK donning “age-simulation” suits to appreciate the difficulties that older customers may encounter when using branches. These suits comprise ankle and wrist weights to limit limb movement, a neck-brace to limit head movement, goggles to blur vision, ear-defenders to simulate deafness and gloves that give little electric shocks to simulate arthritis. Ouch! Spending a day in this suit and visiting a branch provides an understanding of where changes can be made to facilitate access to the branches and services for elderly customers. These changes are already being implemented – from high visibility debit cards to audio ATMs and easier-to-grip pens.

This is a great initiative and is probably driven by the realization that the UK is now dealing with an aging population – a situation shared with most developed and many developing nations.

Most countries are dealing with an aging population

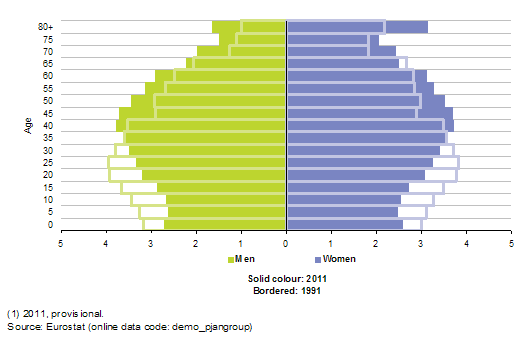

In Europe, every country (except Denmark) is getting older. The median age has increased from 35 to 41 years since 1991, and is forecast to keep rising as birth-rates remain low and life expectancy increases!

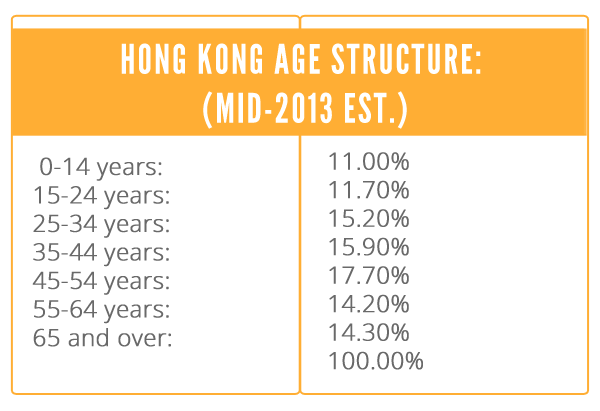

Here in Hong Kong, according to the CIA World Factbook (wow – they don’t just tap our phones, they know how old we are!) 46% of the population are over 45, compared to 43% aged 15-44. Therefore, the average bank, insurance company or biller most probably has more ‘old’ customers than ‘young’ customers.

So why is it then, that almost every technological development in banking and eBilling today is clearly aimed at the “youth” market? Mobile apps for banking and eBilling, Internet banking portals, mobile wallets. They’re all great (well, most are), and I do understand that if you get young customers onto low-cost channels for service and statements/billing, then they’ll likely be on low-cost channels forever. But, the fact is that the older generation (and as I rush headlong towards my 50s I’ll include myself in that description) aren’t going anywhere for a very long time. If my bank doesn’t get me onto eStatements now (and they haven’t!), they can look forward to another 30+ years of posting paper statements to me.

Aging customers want simple technology

It’s not that the 45+ age-group are Luddites that won’t embrace technology either; it’s just that they are more inclined to use it in a different way to younger customers. There isn’t the immediate rush to embrace every new app that’s available, but if something makes life easier, it will be adopted. And the older the customer gets, the simpler the technology needs to become.

As an example, my parents who are in their 70s are very comfortable with email and even dabble with Facebook occasionally. But Internet Banking is just too scary for them, they worry that they’ll click the wrong button and lose their life savings! To move them to eStatements, asking them to find the token, log onto Internet Banking and dig around for the latest statement just isn’t going to work. Too risky for them (and too inconvenient for me). But send a secure PDF eStatement via email instead and suddenly the technology isn’t scary – it’s remarkably familiar and convenient.

If we estimate that turning off paper provides a saving of 50c per statement, my parents and I alone, could save our banks around $300 on stamps annually before we shuffle off this mortal coil!

Why not investigate how your older customers (aka the majority of your base) interact with your current billing technology? This way, you can design electronic customer service channels that specifically meet their needs.

In the meantime, *research shows that email is the best channel for eStatements and eBilling, so if you want to get a head start on servicing your more wrinkly customers cost-effectively, get in touch with Striata and we’ll help you out.

* InfoTrends 2010: ‘The future of electronic presentment & payment in North America’, email delivery topped the consumer’s vote for electronic channel preference at 46%.